A car is really a passion for a lot of the people. None individuals would say a “No” to automobile. Car is loved by everyone. Be it a kid or maybe elderly person, the idea of a car certainly creates joy in their love. In developed countries, every person owns more than a single car. In developing countries, it is considered to be a possession of the folks belonging to the, upper middle, class. For a layman belonging to such a nation, it is still a dream that can’t be pursued. However, the trend is evolving nowadays owing to several financial options agreed to people for purchasing a car.

First of all, compensation claims calculator work best option when ever you aren’t too sure about your injuries and you should not know if it’ll do any good to apply a suit. You get a rough idea of how much you’re owed for your injuries, before making a deal on the settlement. The conclusion you a higher idea goods you deserve as good.

If your expenses can be very expensive and your lifestyle extravagant, you will not regret matter if you are making two hundred dollars grand each year. The real problem is the amount you have ended after you account for expenses. Anyone always to help have only using the best gadgets, designer label clothes, and start expensive your camera .? If you enjoy cannot lifestyle, make sure that your income is plenty above your expenses to account towards your new mortgage payment or your decisions may be financially painful.

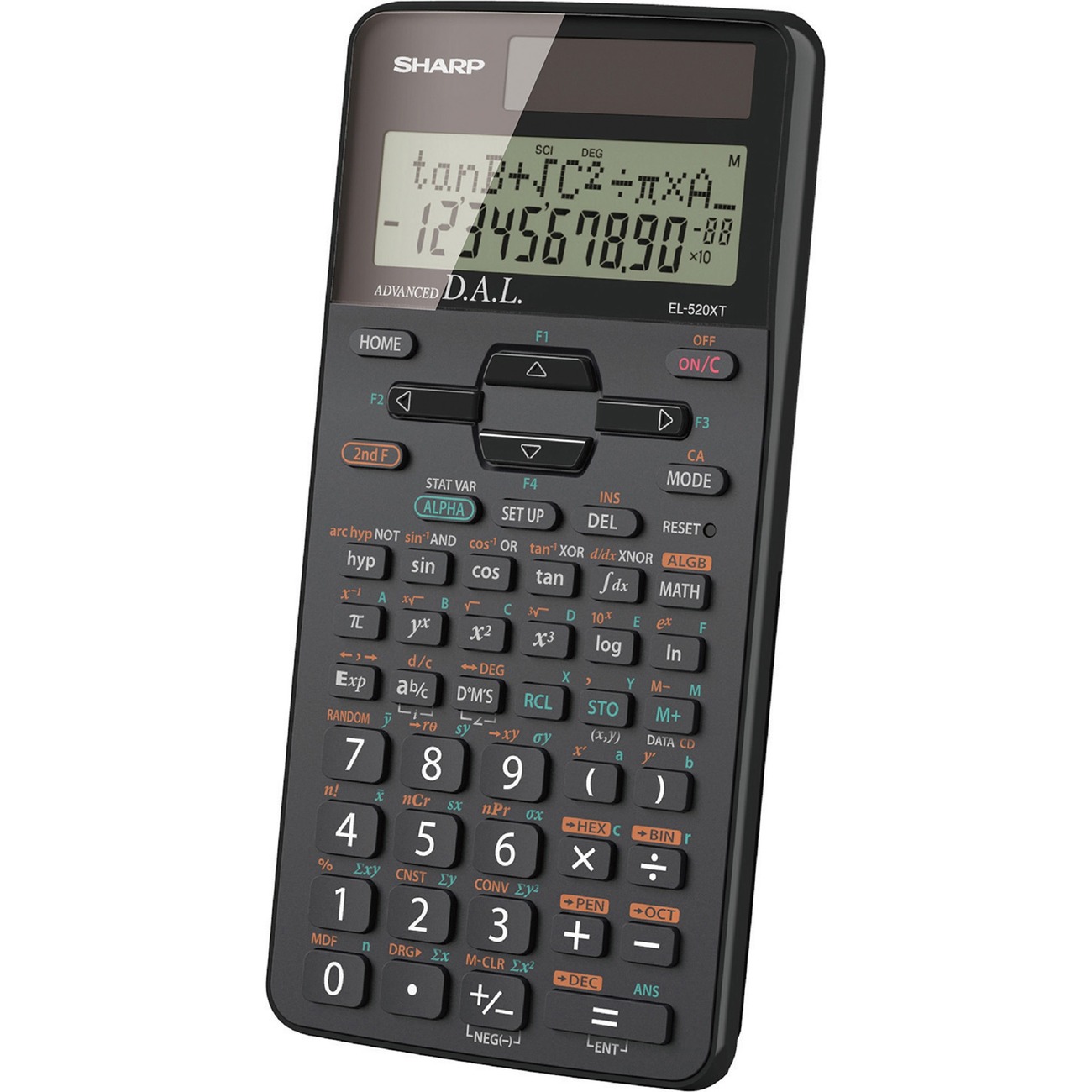

A very simple mathematical mortgage formula calls for you discover out first what the current prevailing average interest rate is. What you can do is simply gather the lenders different rates, add they will and the sum will be divided from your number of lenders quotations. For instance, you inquired from three lenders as well rates are 3, 4, 5, add all figures which is actually going to 12, after that you divide it by things comes to 4 per. That means your average rate get four proportion. You can use your ordinary digital calculator in your own home especially while confronting decimal troubles.

When make use of a mortgage calculator in all probability want evaluate your income to debt ratio. So that you can you understand where your money is going every four weeks. You can then take a good look at these numbers and make any alterations that is needed you cut some costs and some.

Remember great for the of program still has several of the closing costs that are applied to traditional homeowner loans. These fees such as origination fees, title search, property appraisal and an escrow account will be deducted of this amount you will at finishing.

Although this looks like an edge it is reasonably a big disadvantage. Motion for specialists that the main time may are busy paying only interest, spend nothing off the mortgage. When they would so it can gain you could go on making payment on the same quantity interest forever and never pay anything at all off the mortgage.

Would you want to know seniors paying your mortgage every two weeks as an alternative to once per month? Using the right calculator decide it is worth which. You’ll see how much sooner the mortgage will be paid off and how much interest can be saved. An individual have pay off your loan quicker, you can lose some tax total savings. The best calculators will take this into account and show you a “net savings”.

If you beloved this write-up and you would like to obtain far more details pertaining to senior retirement calculator kindly take a look at our own web-site.